Financing & Insurance

Where requested, be prepared to provide updated cash flows and financial statements to your banking partners. Please get in touch if this is required. We will help.

The Govt is providing finance in the form of loans through the Business interruption loan scheme. This is available through all banks.

Speak with your insurer or insurance broker to understand your existing

business insurance coverage.

Download The Business Action Plan Here

Personal Finances

There is a fantastic guide available from a leading consumer support guide. Moneysaving expert. Covering many forms of Personal finance

support during this period

We also advise you to prepare a personal budget and outline your urgent and non-urgent costs. Then look at reducing & stopping first the non-urgent costs then as much as possible the urgent costs.

Download The Personal Finances Action Plan Here

Cash Flow Forecast

As the COVID-19 situation evolves, so does the impact on UK businesses and their response. If you are a Total Books client and are experiencing hardship, please speak with us to understand what options are available to you.

We are here to help. In the current situation, I ask that clients to call me to discuss a plan of action to get through this. I will also be taking calls in the evenings and the weekends to ensure we can help provide information and support by formulating a plan specific to your circumstances.

If you are thinking about how to manage any potential cash flow impacts on your business, you may consider some of these interim steps. Please note this information does not replace independent legal, commercial, financial or tax advice.

How to use the Cash Flow Forecast Chart

Delay tax payments to HMRC

HMRC has a set up a phone helpline to support businesses and self-employed people concerned about not being able to pay their tax due to coronavirus (COVID-19). 0800 0159 5599. Link to HMRC The helpline allows any business or self-employed individual who is concerned about paying their tax due to coronavirus to get practical help and advice.

For those who are unable to pay due to coronavirus, HMRC will discuss your specific circumstances to explore:

- Agreeing on an instalment arrangement

- Suspending debt collection proceedings

- Cancelling penalties and interest where you have administrative diffi culties contacting or paying HMRC immediately

Management reporting

Management reporting

Where practical, be prepared by ensuring your financial statements are kept current, both for internal planning and for provision to external parties. Reconsider whether existing estimates, budgets and cash flow projections are correct, giving consideration to:

Impact on revenue (if any).

Availability of finance and/or cash reserves.

Use revised budgets (taking the above into account) to undertake various.

stress-testing scenarios and model any impact on your business.

Use the attached Cash-flow forecast to project costs, revenue and expenses over the foreseeable 12 months.

Debtors.

Keep the lines of communication open with customers, and consider making contact to discuss any changes in payment or other arrangements.

If you don’t already have direct debit arrangements in place with customers, and it is possible to do so, you should consider whether these are appropriate. We recommend using GoCardless. They are very good as a Direct Debit service provider.

Review your work-in-progress (WIP) to better understand incoming cash flows, and plan accordingly.

Review any contractual arrangements, if required.

Bring your debtors list up to date and contact all of your customers to ensure that any outstanding debts are paid off as soon as possible.

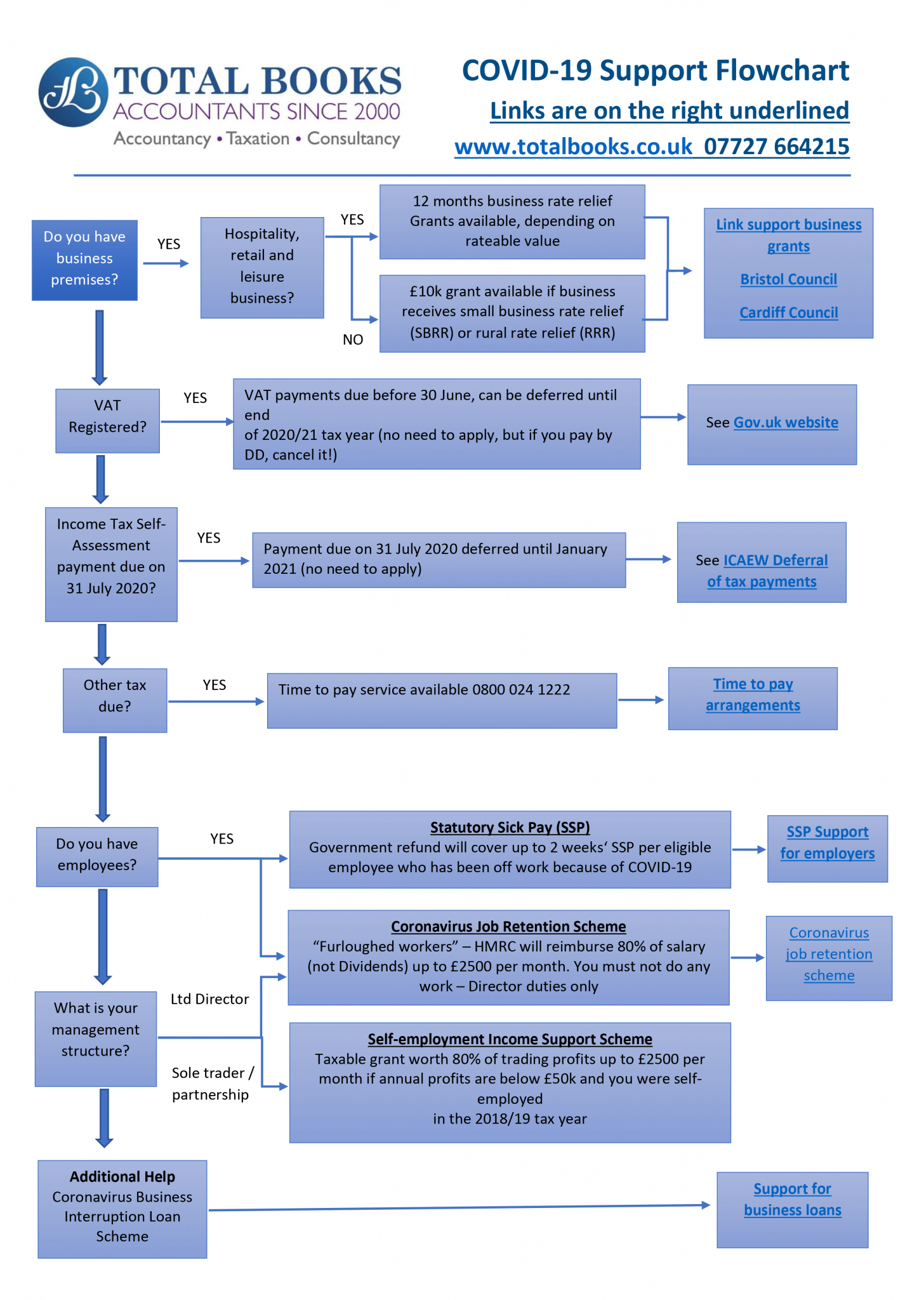

Business funding– Flowchart – Available Govt. support

Creditors & Expenses

If you are experiencing cash flow issues, you may want to review your current repayment terms and have any appropriate discussions with your advisers, suppliers and relationship managers. In the current circumstances, a discussion can lead to varied terms in the business owners favour.

Make sure you’re in regular contact with your accountant, so you can take advantage of any options available to your business, such as specific government schemes or grants. We are constantly updating our clients on a daily basis. Please refer to the Flowchart that details all of the current support.

Go through your most recent profit & loss accounts. If this is not at hand the last three months of your business bank statements, list out all of your service providers—for example, phone, insurance, rent, internet, supplier of goods. Group your outgoing costs into urgent & non-urgent costs. The aim is to stop

the non-urgent costs immediately then look at reducing or putting off payment for your urgent costs at least over the next 3-6 months. This way, you will be able to reduce outgoings & put off immediate payments for the urgent outgoings.

Review all current expenses, to ensure that they are appropriate in this climate, and discuss any potential changes with your accountant.

Where possible, maximise efficiencies by focusing employees on more business-critical areas.

Bounce Back Loans

Thousands of small firms and sole traders – including high street staples like hairdressers, coffee shops and florists – will be eligible for 100% government-backed Bounce Back Loans to help them make it through the coronavirus outbreak.

- small businesses Are now able to apply for quick and easy-to-access loans

- businesses will be able to borrow between £2,000 and £50,000 with the cash arriving within days

- loans will be 100% government backed for lenders, and businesses can apply online through a short and simple form

Are you looking for more financial guidance or advice for your business during Covid 19? Please get in touch and one of our helpful team will be happy to chat with you.

Health & Personal guidance

I sincerely pray you are all well over these difficult times and thank you all for the support & guidance you are giving to each other over the coming months. Some helpful advice I have come across over the last few weeks and some personal thoughts on this matter.

1). A friend who is an A&E consultant doctor has advised we will all get this strain of Flu at some point, so it’s best to prepare for it. In most cases, it will just feel like any other flu. And to follow HMRC advice as linked above.

To build up our natural immunity, ensure you are eating healthy food each day. By exercising each day, even a 10min walk daily is excellent. Take multivitamins, including Vit-C each day. Ensure you get a good night sleep each day. All these things will help build up your immunity.

2). Every cloud has a silver lining. We all complain about not having enough time to spend with our loved ones and at home and doing personal things. So, plan forward to use the expected time that you will be at home. For a lot of businesses, they may be closed for some time; this means continued working from home.

So, enjoy and utilise a period of additional personal time. Rethink and revisit yourselves. Look at ways of making improvements in working practices & rebuilding relationships and looking after those around you, including friends, family, neighbours and loved ones. Spend the time to improve yourselves and being at home, spending quality times on the things that you enjoy.

Please utilise your skills as a business owner and leader in your community to help others. Many local self-help groups have been set up on Facebook, become part of this and utilise your positive mindset & skillset to help others. Also, this would be a great time to sit down and look at your Business and work at improving it. You could utilise the time to carry out an online course to enhance your skills in a crucial area or plan your next marketing strategy. So, you are working on the Business instead of in the Business.

Other countries such as China have seen a three-month turnaround with hospitals going back to normal and factories opening up again. So, it will not be long before we see the light at the end of the tunnel, and we can reopen our businesses.

Useful Links

HMRC: COVID-19: guidance for employees, employers and businesses

ICAEW: Institute of chartered accountants England & Wales – Coronovirus Hub

CBI: Daily Live coronavirus for business webinars